How to Calculate Quick Ratio

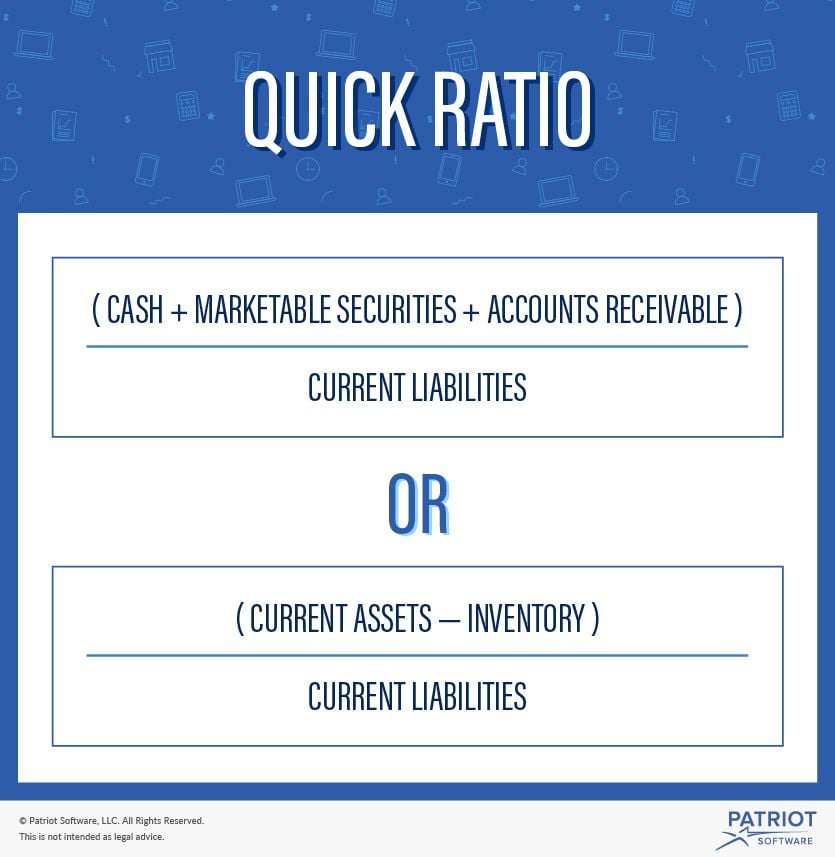

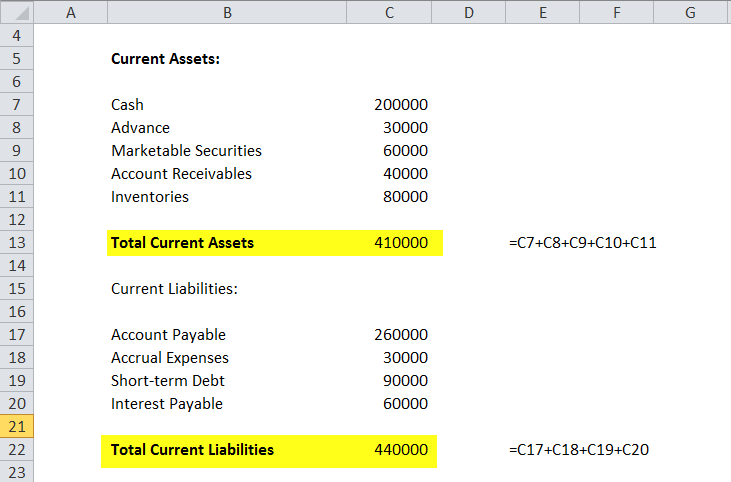

The quick ratio formula takes a companys current assets excluding inventory and divides them by its current liabilities. Quick assets refer to business assets that you can liquidate within 90 days.

/dotdash_Final_How_Is_the_Acid-Test_Ratio_Calculated_2020-01-e78bcddeb1dc41d29bcacaa0072bc773.jpg)

How To Calculate Acid Test Ratio Overview Formula And Example

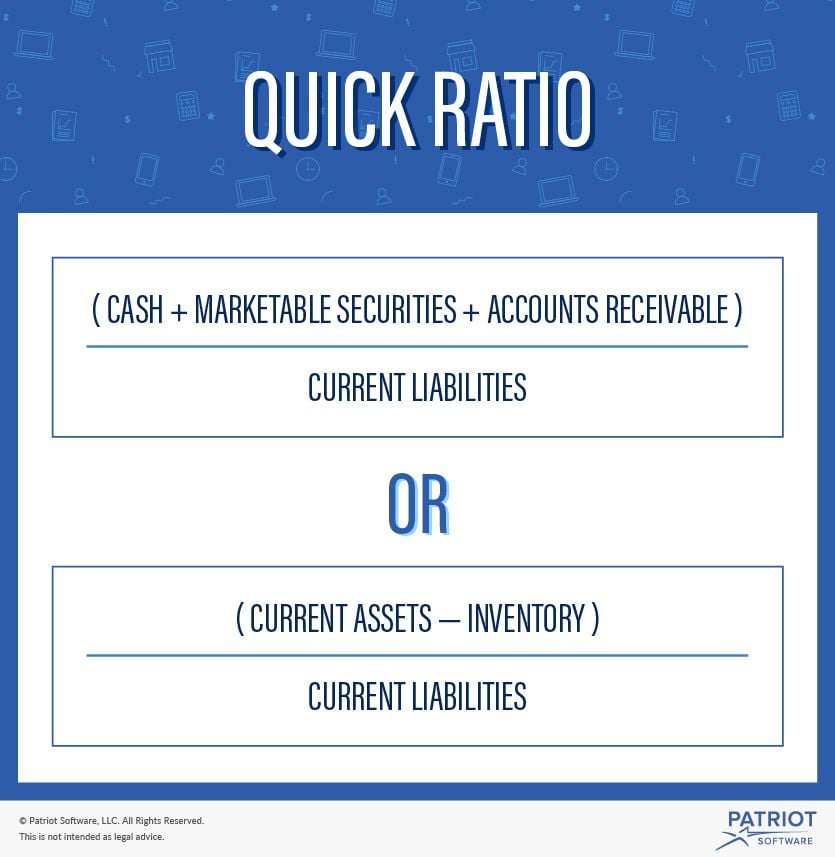

Here the Quick assets mean the Current assets minus all the inventories and minus all the prepaid expenses because only cash or near to cash.

. In other words these are the assets you can convert to cash. This quick ratio calculator has 2 tabs each one offering a specific method to calculate the acid test ratio. The quick ratio is also known as the acid test ratio.

After subtracting 50000 from current assets we find the companys quick asset value is 200000. How to Calculate the Quick Ratio. The quick ratio is a companys cash securities and accounts receivable divided by its current liabilities.

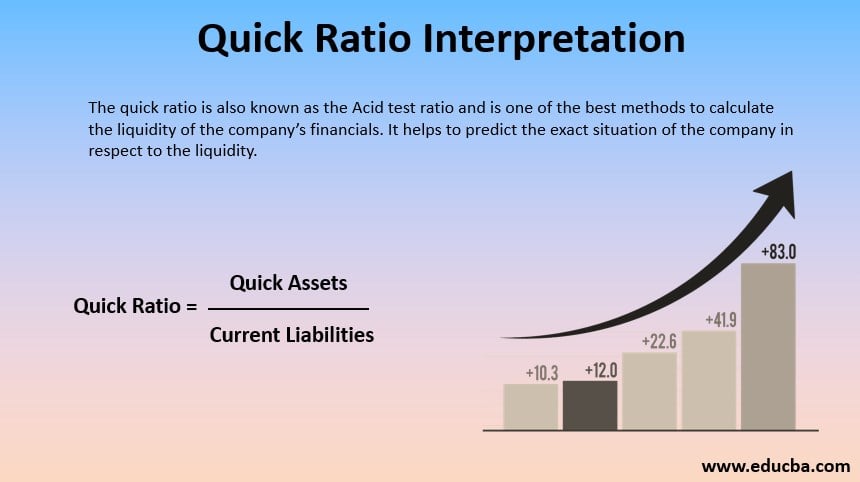

The quick ratio is very. - By 1 st tab Method 1 you can determine the quick ratio by finding the proportion. Quick ratio is a measurement of short-term liquidity or a companys ability to raise cash for paying bills that are due within the next 90 days.

The quick and current ratios are liquidity ratios that help investors and analysts gauge a companys ability to meet its short-term obligations. A quick ratio of 10 or higher indicates that a company. Cash Ratio CE CL.

AccountEdge Pro has all the accounting features a growing business needs combining the reliability of a desktop application with the flexibility of. Quick Ratio Quick Asset Current Liabilities. In simple terms it measures the.

The quick ratio formula. A cash ratio higher than 1 means that you have more cash on hand than current liabilities whereas a ratio. CE Cash and cash equivalents and CL Current liabilities.

Essentially the company can easily liquidate 200000 to cover the. Accounting AccountEdge Pro. Quick Ratio is a liquidity ratio that measures a companys ability to pay short-term obligations.

The quick ratio compares the short-term assets of a company to its short-term liabilities to evaluate if the company would have adequate cash to pay off its. Calculate your current assets. Quick ratio and current ratio have only one thing in common.

Quick ratio and current ratio may sound familiar but they are different. It measures whether a companys current assets are sufficient to cover its current liabilities. The Quick Ratio Calculator will calculate the quick ratio of any company if you enter in the current assets current inventory and the current liabilities of the company.

It can also be calculated as a companys current assets minus inventory. Remember while you want to include current assets in your quick ratio you only want to include liquid assets. Quick Ratio Quick Assets Current Liabilities.

The quick ratio is an indicator of a companys short-term liquidity and measures a companys ability to meet its short-term obligations with its most liquid assets. They are used to compare assets compared. The Quick Ratio is calculated by dividing a companys cash cash equivalents and short-term.

Quick Ratio Formula And Calculator Excel Template

Quick Ratio Can You Pay Your Small Business S Liabilities

Quick Ratio Formula Step By Step Calculation With Examples

Quick Ratio Or Acid Test Ratio Double Entry Bookkeeping

Quick Ratio Interpretation How To Calculate Quick Ratio Interpretation

:max_bytes(150000):strip_icc()/dotdash_Final_How_Is_the_Acid-Test_Ratio_Calculated_2020-01-e78bcddeb1dc41d29bcacaa0072bc773.jpg)

How To Calculate Acid Test Ratio Overview Formula And Example

Comments

Post a Comment